Low Bond Yields Call for a Change

- TRC Financial

- Dec 21, 2021

- 7 min read

Advisors always want to recommend solutions for their clients with a low probability of future surprises. That’s why, when permanent life insurance is required to meet clients’ protection and estate planning needs, policies that provide the certainty of death benefit guarantees have been so appealing.

At first glance, there is little reason to question the wisdom of recommending these permanent, guaranteed life insurance products.

Until now. Today, as world events and financial market developments continue to upend our assumptions about risk, certainty, and control — and the interest rates being earned on conservative bond investments remain at historically low levels — it’s time to take a closer look at permanent life insurance with alternatives to traditional guarantees.

Low bond yields mean that many insurance companies, which must rely on conservative bond investments to support product pricing and no lapse guarantee benefits, have had no recourse but to raise the cost of insurance (COI) on life insurance policies.

Generating income from their reserves is a huge part of their economic engine, and the returns required to sustain guaranteed death benefits have declined to the point that other actions are needed.

For example, as Figure 1 demonstrates, the cost of no lapse guarantee life (NLG) riders has risen by 35% over the last decade as the average yield of low-risk corporate bonds has declined.

Figure 1. Trends in NLG Prices Compared to Corporate Bond Yield Average

Moody's Source:Federal Reserve Economic Data, https://fred.stlouisfed.org

Guarantee Cost is based on the present value of 10-Pay VUL Policy, premium guaranteed to age 120 for male, age 55, Best Non-Smoker

This interest rate environment presents an ongoing challenge for insurance carriers. Many have withdrawn guaranteed products from the market. Others are reducing their guarantees or repricing their policies, so guarantees have become significantly more expensive.

For policy owners, the impact is felt in multiple ways:

Existing policies have underperformed, leading to lapses for policy owners not prepared to pay the additional premiums required.

Long-held policies that were presumed to be "paid up" using cash value growth can no longer stay in force without considerable extra premium outlays.

Premiums have substantially increased for new policies with guarantees.

Popular product features have been discontinued.

So, what is the alternative to the steadily increasing prices policy owners must pay for guaranteed death benefits?

VUL’s long-term potential for better outcomes

Although life insurance policies with guarantees are easy to justify and explain, they may no longer be the best option for clients who need a flexible, long-term solution. Financial professionals should consider whether the products they are recommending offer clients the best long-term value under a variety of conditions.

Variable Universal Life Insurance (VUL) provides life insurance protection plus the opportunity for market-driven cash value growth through an array of investment options. Because the cash value in a VUL policy can be invested in a wide range of securities, the policy has the potential to achieve significantly better long-term returns while mitigating downside risk if the policy’s underlying investments are well-managed.

With VUL, the guarantee is replaced with the probability of achieving better returns over time for the policy’s cash value investments. Policy assets that are invested in diversified portfolios of securities have the potential to deliver long-term outcomes that will exceed the performance of an all-bond portfolio. That, in turn, can lead to higher cash values and, because less premium may be needed to fund the policy, a better overall return on the insurance strategy.

With greater potential for upside returns, considerable premium and death benefit flexibility, access to cash values, and a wide range of investment options, VUL can give clients a better option for long-term success in meeting their protection and wealth transfer goals.

Investors who add equities can anticipate beating an all-bond portfolio over time. Market volatility is the central concern about VUL. But history and data show that, for the long-term, the probability of success is greater because VUL offers the option of investing in a portfolio that includes equities. Most of the risks associated with VUL can be reduced by properly funding the policy, frequent and effective reviews, and taking a long-term view.

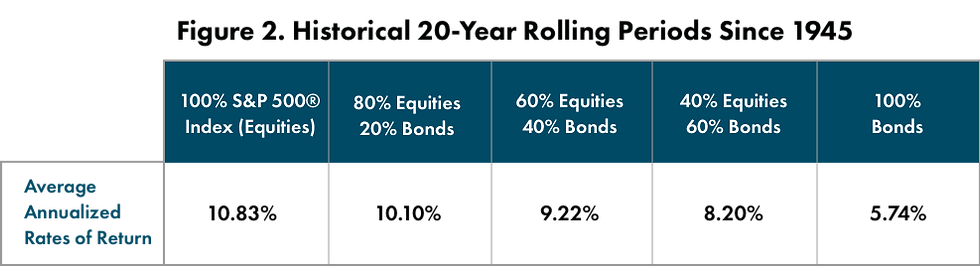

In fact, as Figure 2 shows, a review of historical performance of a variety of portfolio allocations suggests that, over 20 years, a portfolio including at least 40% equities delivered strong returns and exceeded average bond returns by more than 2%.

Figure 2. Historical 20-Year Rolling Periods Since 1945

Assumptions:

The stock market is represented by the S&P 500. The bond market is represented by 1/3 LT Corporate Bonds, 1/3 LT Government Bonds and 1/3 IT Government Bonds. Each year’s rates of return are annual from January 1st through December 31st. Data points start in 1926, and end in 2020. The investments are rebalanced to their original allocation each year. There are a total of 86 ten year performance periods. All data is provided by Ibbotson. Past Performance is not indicative of future results. This information has been taken from sources, which we believe to be reliable, but there is no guarantee as to its accuracy. An investment cannot be made directly in an index.

These numbers suggest that:

An approach to investing a VUL’s cash value that seeks to outperform the stock market’s historical average of roughly 7% over time (based on a 10% average total return adjusted for inflation) will create enough cash value to keep the policy in force.

Client illustrations that fund the cash value at less than a 7% rate of return may result in a higher premium but will also assure the policy’s longevity for the insured’s lifetime.

Flexibility and control adapting to each client’s needs

As the amount and type of taxes imposed on income, investment earnings, and estates shift over time, VUL also is an ideal chassis to address the changing tax and estate planning needs of clients.

VUL offers the policy owner important flexibility in premium payments, the death benefit, and investment choices – a combination that other permanent insurance policies may not be able to offer. These three advantages are essential tools for planning in today’s world.

Flexibility in premiums and death benefits

Needs change with time. Does an insurance policy purchased 10 years ago satisfy a client’s current needs, and will those needs be the same in 15, 20, or 25 years?

VUL is an excellent vehicle for addressing changing needs over time. For example, if policy owners want their insurance benefits to ratchet up, they can always purchase a VUL policy designed with a death benefit that grows as they add more cash into their policies. Or if they don’t need as much protection or estate tax funding going forward, they can reduce the death benefit over time. A variable life policy allows for considerable flexibility for these situations.

The ability to modify the amount and frequency of premium payments also may appeal to clients who have sufficient money to fund the policy at a high level in its early years. During periods of high market growth, a well-funded VUL policy can make money faster than the insurance charges being taken from cash value. The resulting higher cash value will lessen the net amount at risk (and the associated policy charges).

Two Examples

Consider the case of a business owner who purchased a $15 million Survivorship Variable Universal Life policy instead of a traditional Whole Life policy because he wanted VUL’s greater potential to grow the cash value over time. While he originally intended to pay a level premium for 20 years, when the opportunity came up to sell his company, he was able to have the policy paid up more easily due to the growth within the VUL contract.

On the other hand, consider the client who was initially planning to have his VUL policy paid up in five years. With his business experiencing difficulties due to the COVID-19 pandemic, he chose not to make a premium payment in 2020.

This kind of flexibility is not generally available in most guaranteed policies, and makes VUL a good option for many client scenarios, including:

Clients in their 50s and 60s who have substantial taxable estates and want to create liquidity over time to give their families a better way to manage wealth transfer and/or estate taxes in the future.

Younger clients in their 40s who may choose VUL for its long-term, tax-free cash value accumulation and tax-preferred growth to supplement future retirement income needs.

Control of Investment Selection and Management

Managing client expectations about volatility and returns, matching their portfolio allocations with their risk profiles, and controlling downside risk are at the heart of successful investment management in any situation. For VUL, the ability to select from a broad array of investment options means financial professionals have the flexibility they need to successfully manage each client’s cash value portfolio performance over the long-term.

VUL policies provide the option to be fully invested in the stock market, bond market, and fixed crediting rate accounts, offering true variety to pivot based on assumptions about where financial markets may be headed in the future – and how much risk is appropriate for each client’s portfolio.

Meeting clients’ long-term insurance goals with the potential for better outcomes

Successful management of VUL policies requires a commitment to the future.

VUL is a Long-term Solution

Multiple investment analyses confirm that the longer the time horizon, the narrower the band of volatility and the more limited the range of outcomes. However, while equities will likely outperform fixed income investments over time, their short-term returns can vary greatly from one year to the next. That’s why it’s so important to take a long view on investing a VUL policy’s cash value and manage the underlying portfolio – and client expectations — accordingly.

VUL Requires Consistent, Active, In-Force Management

To be successful, the cash value investments underlying a VUL policy must have consistent, ongoing management. A skilled financial professional must regularly monitor the VUL policy to make sure that:

Its cash value performance is meeting expectations.

Premiums and cash value are not out of line with what is needed to sustain policy benefits and tax-favored status.

Investment allocations, premiums, and death benefits are adjusted as needed.

Client expectations are being managed — with no surprises — as financial markets and client circumstances require adjustments to the policy.

We are here to help you evaluate how to use a VUL life insurance policy for the protection, accumulation and transfer of wealth. Schedule a call with our team - we look forward to having the opportunity to speak with you.

This is not an offer to sell a security or insurance product. This information is provided for informational purposes only and should not be construed as legal or tax advice. You should discuss your circumstances with a financial professional before making any decisions. This material and the opinions voiced are for general information only and are not intended to provide specific advice or recommendations for any individual. https://www.trcfinancial.com/disclosure

Comments